As we reported a little over a week ago, deliverable gold has been literally pouring out of the vaults of the COMEX and major New York bullion banks. The biggest question in the industry has been where exactly is this gold going? One possible clue as to where a sizable portion of this gold may be heading is contained in just released reports by the Chinese government regarding their central bank’s recent gold accumulations.

As we reported a little over a week ago, deliverable gold has been literally pouring out of the vaults of the COMEX and major New York bullion banks. The biggest question in the industry has been where exactly is this gold going? One possible clue as to where a sizable portion of this gold may be heading is contained in just released reports by the Chinese government regarding their central bank’s recent gold accumulations.

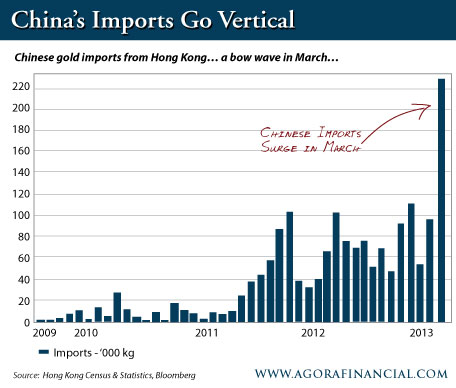

Although China’s 2013 gold purchases got off to somewhat of a slow start, it has since gone parabolic. After a record high 114 metric tons imported in December 2012, January’s figures showed only 51 tons for the Asian giant. However, February imports nearly doubled to 97 tons, well above 2012’s average monthly import numbers.

As robust as China’s February gold stats were, they were completely blown out the door by March’s numbers. Those numbers revealed that during March, China imported a whopping 223 tons of gold in just ONE MONTH! That was an all time monthly high and eclipsed the total imported tonnage for the first three months of 2012 combined.

As robust as China’s February gold stats were, they were completely blown out the door by March’s numbers. Those numbers revealed that during March, China imported a whopping 223 tons of gold in just ONE MONTH! That was an all time monthly high and eclipsed the total imported tonnage for the first three months of 2012 combined.

Just to put this into perspective, the amount of gold imported by China during March surpassed the total holdings of many central banks including Mexico, South Africa, Greece, Singapore, and many others. China’s 223 tons was nearly half of the entire gold holdings of the European Central Bank!

The recent tsunami in China’s gold imports should absolutely not be ignored. China’s gold tally is surging and by the end of the month could be well in excess of 7,000 metric tons – placing it second in the world to the United States.

It seems beyond doubt that China is making a major move to build the basis for its foreign traded currency, the renminbi, upon precious metals. Three summers ago, China quarantined all gold and silver being mined domestically in partnership with foreign mining companies, requiring these companies to sell the entirety of their production to the Chinese government.

Simultaneously, China has been working overtime to establish currency swap deals and trade exchanges that bypass the current world reserve currency, the US dollar. As reported on March 26th this year, China’s Central Bank concluded its first bilateral currency swap with its South Korean counterpart. This was the nineteenth such foreign trade/currency agreement that China has executed since it started this program in 2008. These agreements span the entire globe and include such diverse countries as Russia, Malaysia, Iceland, New Zealand, Australia, Brazil, and Singapore. China’s direct trade with these nineteen nations in 2012 totaled US $320 billion and NOT a single dollar of that amount was conducted in US funds.

China has a very long memory. Its history is thousands of years old and the Chinese have always held gold in the highest regard. China also remembers the humiliating and devastating Opium Wars and despotic, punitive trade tariffs waged against it by England, the United States, and other European colonial powers during the Nineteenth and early Twentieth Centuries. The Opium Wars and the unequal treaties forced on China by the West robbed millions and millions of ounces of silver from the Chinese Treasury and contributed to the collapse of the Qing Dynasty – the country’s last imperial dynasty – in the early years of the Twentieth Century.

People, we are watching a powerful and dynamic direct confrontation with the not so mighty US dollar world reserve currency. While our nation works overtime on bankrupting its Treasury and its citizens with untold trillions of unrepayable debt, China forges ahead relentlessly to build a solid economic foundation underpinned by precious metals. We suggest, dear readers, that you do the same.

To learn more about the rewards of precious metals investing, including how to fund your existing IRA with gold or silver, call Liberty Gold and Silver seven days a week at 888.751.3330. To learn about the most generous affiliate marketing program in the precious metals industry, please visit the Liberty Gold and Silver Affiliate Marketing Program. We're happy to spend as much time as you need to discuss the details with you.

© Copyright 2013 Liberty Gold and Silver, All rights Reserved.

Written For: Liberty Gold and Silver News Blog